Certificate in Capital Markets (CCM)

Programme Objective

The Certificate in Capital Markets (CCM) is the only pre-requisite for capital market practitioners to pave the way to becoming a professionally qualified Registered Investment Adviser (RIA) registered by the Securities and Exchange Commission (SEC) of Sri Lanka and accepted by the industry.

Even though CCM was initially started in English Medium in year 2008, SEC successfully developed CCM modules in Sinhala Medium and inaugurated first Sinhala Medium Batch in the year 2009 so that many students could enroll with the programme.

CCM ensures that professionals practicing in the industry possess the competencies essential to secure the confidence of investors in the capital market. Therefore, this certification course assists to develop a pool of candidates who are trained in fundamentals of capital markets.

Obtaining this qualification will pave the way for recruitment in the areas of Banking, Stock Brokering, Money Brokering, Fund Management, Investment Banking, Corporate Financing, Venture Capital, Insurance, Leasing & Finance, Accounting, Valuation, Financial Consulting etc.

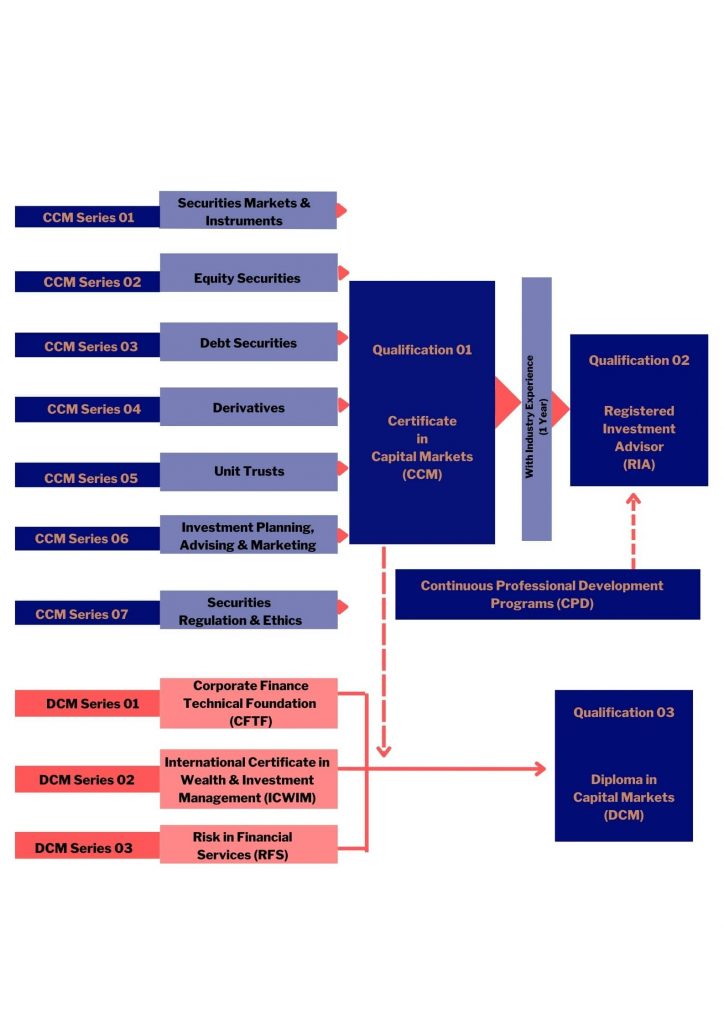

Qualification Framework

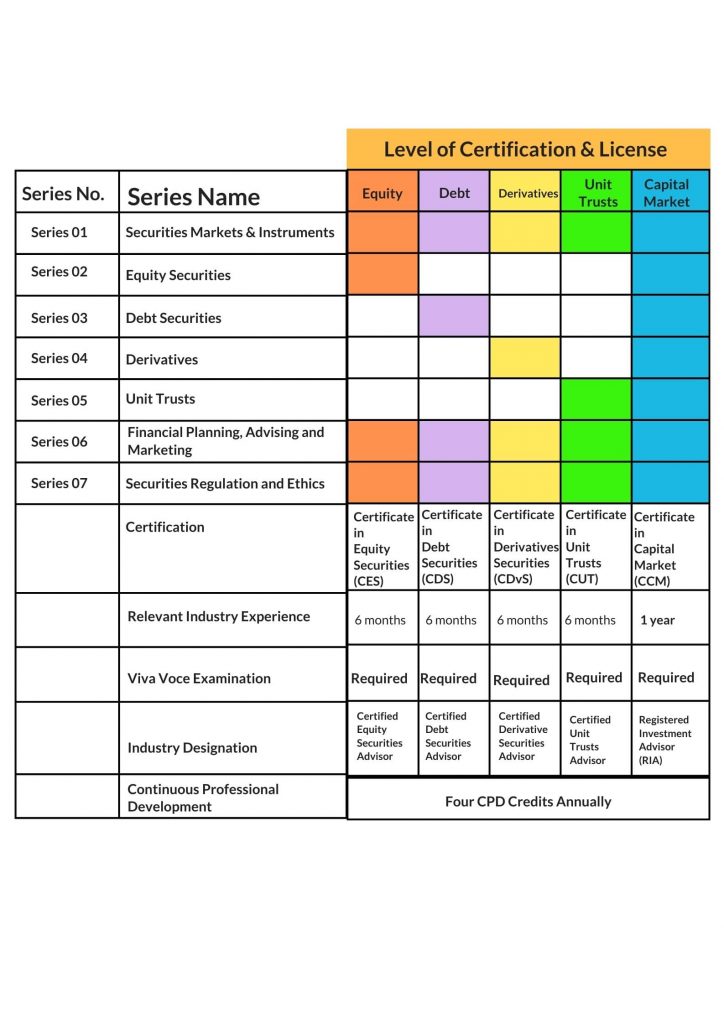

There are five different levels of certifications under the qualification framework (QF) where each of the first four certificates will form the basic training required to obtain the license as an investment advisor for each asset class.

The Certificate in Capital Markets (CCM) will be the apex qualification to become a Registered Investment Advisor (RIA).

The Certificate in Capital Markets (CCM) will be the apex qualification to become a Registered Investment Advisor (RIA).

- Certificate in Equity Securities

- Certificate in Debt Securities

- Certificate in Derivatives (to be introduced in future)

- Certificate in Unit Trusts

- Certificate in Capital Markets

Level of Certification & License

There are five different levels of certifications under the qualification framework (QF) where each of the first four certificates will form the basic training required to obtain the license as an investment advisor for each asset class.

The Certificate in Capital Markets (CCM) will be the apex qualification to become a Registered Investment Advisor (RIA).

The Certificate in Capital Markets (CCM) will be the apex qualification to become a Registered Investment Advisor (RIA).

- Certificate in Equity Securities

- Certificate in Debt Securities

- Certificate in Derivatives (to be introduced in future)

- Certificate in Unit Trusts

- Certificate in Capital Markets

Individual Asset class Advisor

On completion of the first level of certification and with six months of relevant industry experience, candidates may proceed to facing a VIVA VOCE examination conducted by a panel comprising SEC, Colombo Stock Exchange (CSE), and industry professionals in order to obtain the designation corresponding to the asset class in which he or she has selected.

- Certified Equity Securities Advisor

- Certified Debt Securities Advisor

- Certified Derivative Securities Advisor

- Certified Unit Trust Advisor

Registered Investment Advisor (RIA)

A candidate will be required to complete all seven series in order to earn the CCM qualification. On completion of the CCM and with one year of relevant industry experience candidates may proceed to facing a VIVA VOCE examination conducted by a panel comprising SEC and CSE officials and industry professionals in order to become a RIA.

Continuous Professional Development (CPD)

As per SEC Circular no. 08/2009 (Ref: SEC/LEG/09/10/31) dated 13 October 2009 and SEC Directive no. Ref: SEC/CMET/2018/12/103 dated 18 December 2018, all Investment Advisors (Registered Investment Advisors and Individual Asset Class Advisors) are required to earn four CPD credits mandatorily as minimum annual requirement during their licensing year.

This course provides a survey of the financial markets and instruments including money, bond, stock, derivative and mutual fund markets. This is intended to build the overall knowledge of the functioning of the securities markets and all the instruments. The coverage will include

| Overview of the Financial Markets |

| Structure and Functions of Financial Markets |

| Mutual Funds (Unit Trusts) |

| Central Banks and Monetary Policy |

| Money Markets |

| Derivative Securities Market |

| Capital Markets |

The course on equity securities focuses on the knowledge required to understand the equity securities and markets and covers the following topics.

| Introduction to Investments |

| Time Value of Money |

| The Stock Market |

| Introduction to Risk and Return |

| Stock Market Indices |

| Stock Valuation |

| Capital Market Theory Basics |

| Financial Statement Analysis |

| Technical Analysis |

| Economic and Industry Analysis |

The course in debt securities covers the essential knowledge in debt securities and markets. This will test the knowledge and skills required to perform job functions in the areas of Government debt securities and corporate debt securities. Both money market and capital market debt instruments will be covered. The major topics covered include the following:

| Corporate Debt Instruments |

| Valuation of Bonds |

| Determination of Bond Yields |

| Government Debt Securities and Markets |

| Corporate Debt Securities Market |

| Credit Rating and Analysis |

As the derivatives markets in Sri Lanka will develop in the future, it is critically important that Sri Lanka’s securities industry have professionals who have the knowledge to understand, analyze and advise on derivatives products such as options, futures, forwards, and swaps. However, at present we do not conduct lectures for this Series. When lectures commence the Series will focus on fundamentals of trading, pricing and regulations of options and futures and covers the following topical areas.

| Organization and functions of derivatives markets |

| Types and characteristics of derivatives products |

| Call and put options |

| Financial forwards |

| Financial futures contracts |

| Forward rate agreements |

| Interest rate futures |

| Interest rate swaps |

| Trading, hedging and investment strategies |

| Derivatives trading, clearing and settlement |

| Derivatives regulations |

This course will cover the specialized knowledge and skills expected of an investment professional dealing with mutual fund / unit trust products. This is specially designed for investment professionals employed by unit trust companies in Sri Lanka. The topics include

| Introduction to Unit Trust |

| Organization and Structure of Unit Trust |

| Unit Trust Fees and Expenses |

| Valuation and Pricing of Unit Trust |

| Evaluating Unit Trust |

| Unit Trust Regulations |

The Series 6 is designed to provide the specific knowledge and skills needed to provide proper investment advice to clients. This course will focus on the following areas.

| Financial planning process |

| Evaluating the investment profile of a client |

| Drafting a comprehensive investment policy statement for individual investors |

| Creating an Investment portfolio |

| Investment objectives and constraints of clients |

This course is intended to give candidates a broader understanding of laws and regulations governing Sri Lanka’s securities industry. The Series 7 Examination will cover the following topics.

| SEC Act, Rules & Circulars |

| Company Takeovers & Mergers Code |

| Central Depository System Rules & Regulations |

| Automated Trading System Rules |

| Stockbroker Rules |

| Listing Rules |

| Corporate Governance Directions & Codes |

| Company Law |

| Ethical Framework and Best Practices in Professional Conduct |