Background

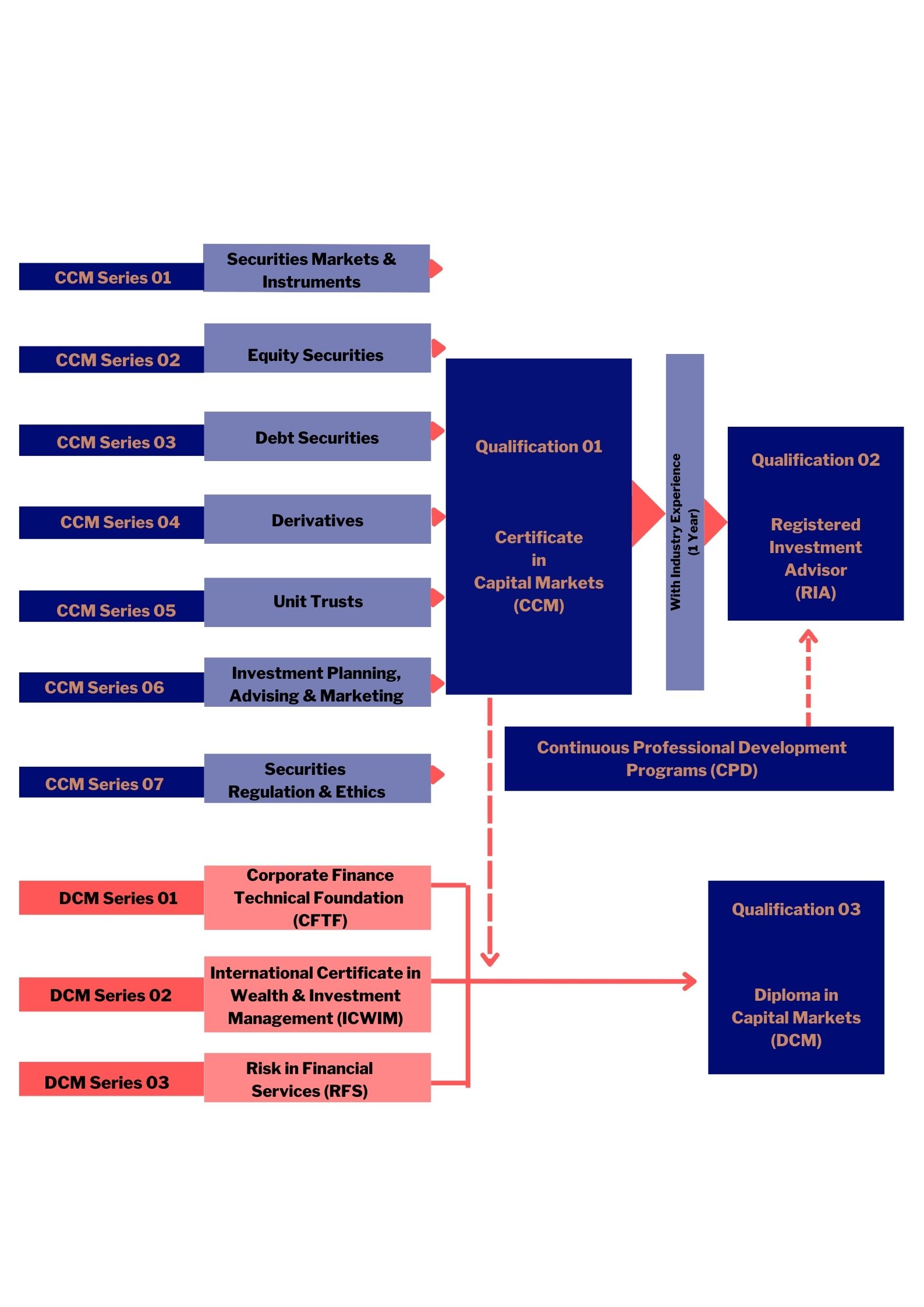

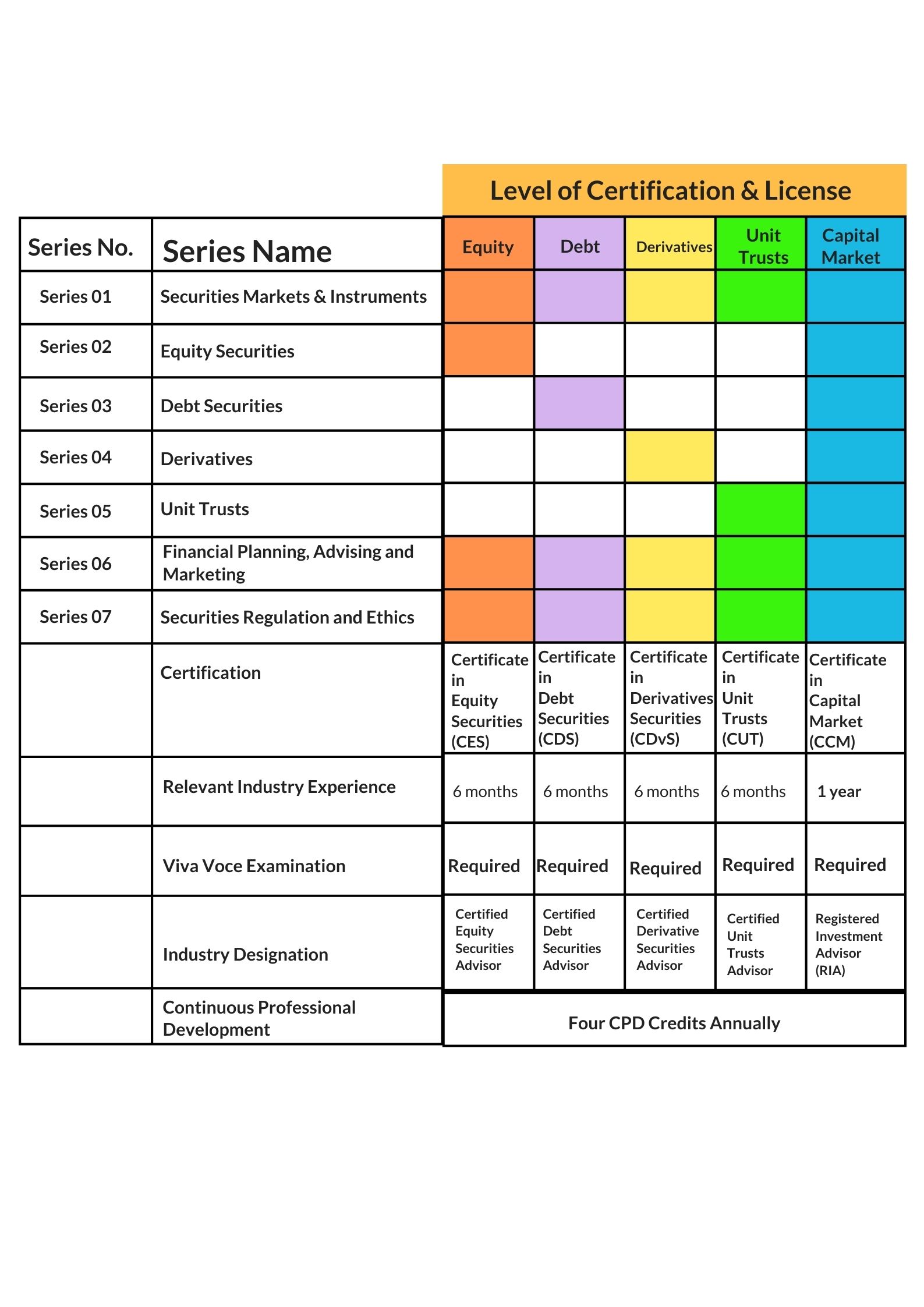

The Securities and Exchange Commission of Sri Lanka (SEC) introduced a Capital Market Qualification Framework (QF) under the ADB technical assistance. This QF is intended to ensure a minimum level of competency for investment advisors and thus serves as a quality standard for investment advisors in the stock broking industry in Sri Lanka.

The QF has established the Certificate in Capital Markets (CCM) as the basic securities market certification, and this is mandatory to be licensed as a Registered Investment Advisor (RIA) in Sri Lanka.