The Certificate in Capital Markets (CCM)

Prospective students

Certification

1.Certificate in Equity Securities

2. Certificate in Debt Securities

3. Certificate in Derivatives (to be introduced in future)

4. Certificate in Unit Trusts

5. Certificate in Capital Markets

Individual Asset class Advisor

1. Certified Equity Securities Advisor

2. Certified Debt Securities Advisor

3. Certified Derivative Securities Advisor

4. Certified Unit Trust Advisor

Registered Investment Advisor (RIA)

A candidate will be required to complete all seven series in order to earn the CCM qualification. On

completion of the CCM and with one year of relevant industry experience candidates may proceed to

facing a VIVA VOCE examination conducted by a panel comprising SEC and CSE officials and industry

professionals in order to become a RIA.

Continuous Professional Development (CPD)

As per SEC Circular no. 08/2009 (Ref: SEC/LEG/09/10/31) dated 13 October 2009 and SEC Directive no.

Ref: SEC/CMET/2018/12/103 dated 18 December 2018, all Investment Advisors (Registered Investment

Advisors and Individual Asset Class Advisors) are required to earn four CPD credits mandatorily as

minimum annual requirement during their licensing year.

Programme content

CCM Series 1 – Securities Markets & Instruments

- Overview of the Financial Markets

- Structure and Functions of Financial Markets

- Mutual Funds (Unit Trusts)

- Central Banks and Monetary Policy

- Money Markets

- Derivative Securities Market

- Capital Markets

CCM Series 2 – Equity Securities

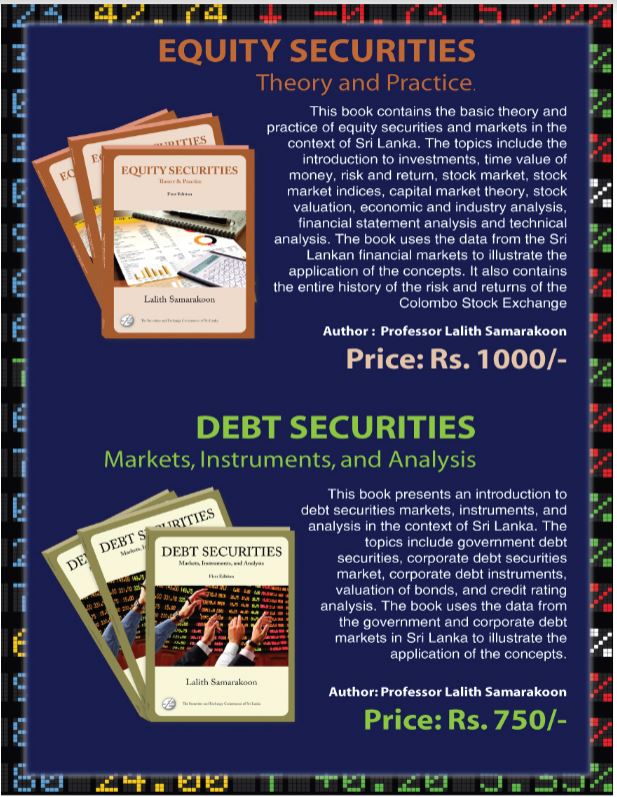

The course on equity securities focuses on the knowledge required to understand the equity securities

and markets and covers the following topics.

- Introduction to Investments

- Time Value of Money

- The Stock Market

- Introduction to Risk and Return

- Stock Market Indices

- Stock Valuation

- Capital Market Theory Basics

- Financial Statement Analysis

- Technical Analysis

- Economic and Industry Analysis

CCM Series 3 – Debt Securities

- Corporate Debt Instruments

- Valuation of Bonds

- Determination of Bond Yields

- Government Debt Securities and Markets

- Corporate Debt Securities Market

- Credit Rating and Analysis

CCM Series 4 – Derivatives

- Organization and functions of derivatives markets

- Types and characteristics of derivatives products

- Call and put options

- Financial forwards

- Financial futures contracts

- Forward rate agreements

- Interest rate futures

- Interest rate swaps

- Trading, hedging and investment strategies

- Derivatives trading, clearing and settlement

- Derivatives regulations

CCM Series 5 – Unit Trust

- Introduction to Unit Trust

- Organization and Structure of Unit Trust

- Unit Trust Fees and Expenses

- Valuation and Pricing of Unit Trust

- Evaluating Unit Trust

- Unit Trust Regulations

CCM Series 6 – Financial Planning, Advising & Marketing

- Financial planning process

- Evaluating the investment profile of a client

- Drafting a comprehensive investment policy statement for individual investors

- Creating an Investment portfolio

- Investment objectives and constraints of clients

CCM Series 7 – Securities Regulation & Ethics

- SEC Act, Rules & Circulars

- Company Takeovers & Mergers Code

- Central Depository System Rules & Regulations

- Automated Trading System Rules

- Stockbroker Rules

- Listing Rules

- Corporate Governance Directions & Codes

- Company Law

- Ethical Framework and Best Practices in Professional Conduct

Registration

Entry qualifications

Professional level entry qualification category

Entry to CCM is permitted if the student possesses full/part 1 qualifications from any of the below mentioned professional institutions:

- Institute of Chartered Accountants of Sri Lanka (ICASL),

- Chartered Institute of Management Accountants (CIMA),

- Association of Chartered Certified Accountants (ACCA),

- Sri Lanka Institute of Marketing (SLIM),

- The Association of Accounting Technicians of Sri Lanka (AAT), or

- Any other qualification acceptable to the FSA.

Academic level entry qualification category

Entry to CCM is permitted if the student possesses a Bachelor’s Degree in any of the disciplines mentioned below:

- Finance, Banking, Business Administration, Accounting, Management, Economics,

Marketing, MIS / IT, Engineering, Law or Arts.

Documentation & Payment

Relevant Documentation

- Completed Application Form

- Certified 2 Copy of Advanced Level Certificate or any other relevant qualification as per the entry

- qualification requirement

- Certified 3 Copy of National Identity Card/Passport Copy

- Original Payment Slip(Customer Copy) of the Bank

Payment Details

Course Fee is subsidized by the SEC for all students.

CCM Registration fee : Rs 50,000/-

Registration fee for separate Certifications:

Series No: | Series Name | Fee Structure | * Mandatory subjects to be followed for all certifications . |

Series 1* | Securities Markets & Instruments | Rs. 10,000.00 | |

Series 2 | Equity Securities | Rs. 10,000.00 | |

Series 3 | Debt Securities | Rs. 5,000.00 | |

Series 4 | Derivatives | – | |

Series 5 | Unit Trusts | Rs. 5,000.00 | |

Series 6* | Financial Planning, Advising and Marketing | Rs. 10,000.00 | |

Series 7* | Securities Regulation and Ethics | Rs. 10,000.00 |

Registration fee excludes the examination fees. Payments for the examinations should be made at the time of applying for the examination.

Examinations

Examinations will be held after completing lectures for each series.

Registration

Application

We are strict with examinations deadlines. Applications receiving after the dead line will

be automatically transferred to the next available examination.

Admission

Student should collect the Admission for the examination at the time of handing over the

examination application with payment. The admission should be attested by a Justice of

Peace /Commissioner of Oaths/Notary Public and submitted on the day of the

examination.

Payment

Examination Fee: Rs 2000/- per Series

Cheques and cash should be deposited to Bank of Ceylon (Corporate Branch) A/C

No. 9919753 and forward the original receipt along with the application form (All

cheques should be drawn in favor of “Securities and Exchange Commission of Sri

Lanka” crossed ”A/C Payee Only”)

Release of Results

Prescribed calculator

Publications

Exemption scheme

Registered Investment Advisor

Training Report

All candidates who are eligible to apply for the VIVA VOCE Examination should complete a

training report. The purpose of completing this training report is for the panel members to

identify if the candidate has obtained six months of “Relevant Work Experience” specified by the

SEC prior to awarding the “RIA” status. In order to fulfill this final criteria the candidates should

possess NOT LESS THAN 800 hours of “on the job training” in relation to the subject areas

followed at the CCM Programme.

VIVA VOCE Examination

The RIA is awarded after submission of the training report (Training guide provided by the SEC)

and facing an interview with a panel of industry experts who will evaluate the candidates on their

overall performance.

Training Record Book Fee : Rs 1,000/- (VAT included)

RIA VIVA VOCE Examination Fee : Rs 5,000/- (VAT included)